Down Payment Assistance is Available!

Updated April 23, 2025

All of our programs are grants. No repayment required.

The top 3 programs that we recommend are:

- FHA Down Payment Advantage

- FHA Energy Efficient Mortgage Program

- Conventional Down Payment Assist

All of these programs require homebuyer education in order to qualify. Start your homebuyer education course today to get started.

Up To $25,000 In Benefits Available Per Household

Down Payment Assistance available up to $20,000 for the purchase of a primary residence. This program will allow you to move into a home for ZERO down. The Eligibility Checker will find the best program for you based on income and credit score.

No Income Limits

There are down payment assistance grants available that currently have no income restrictions. The programs are difficult to find as there are only a handful of approved lenders. Use our Eligibility Checker to find the best program for you.

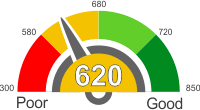

620 Credit Scores Allowed

Down Payment Assistance Grants Available with credit scores as low as 620. Most programs are going to require significantly higher scores to qualify. Use our Eligibility Checker to find the best program.